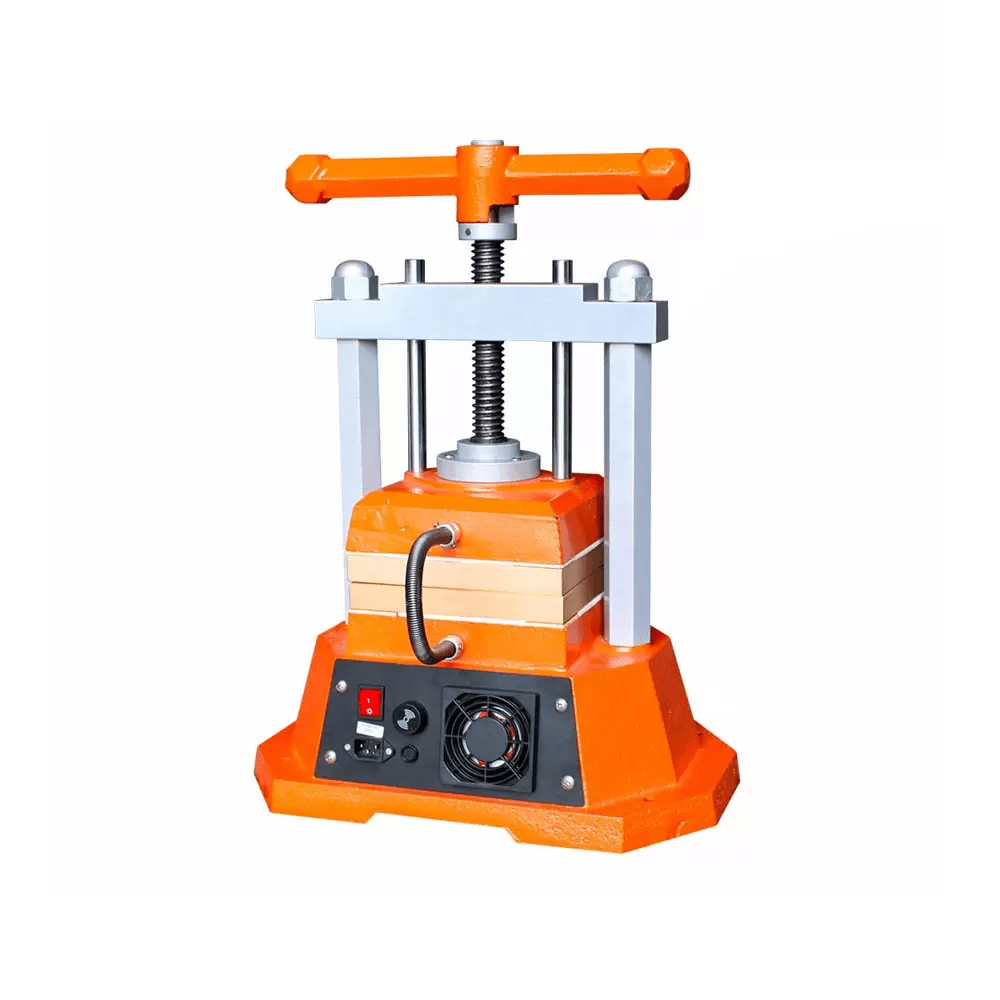

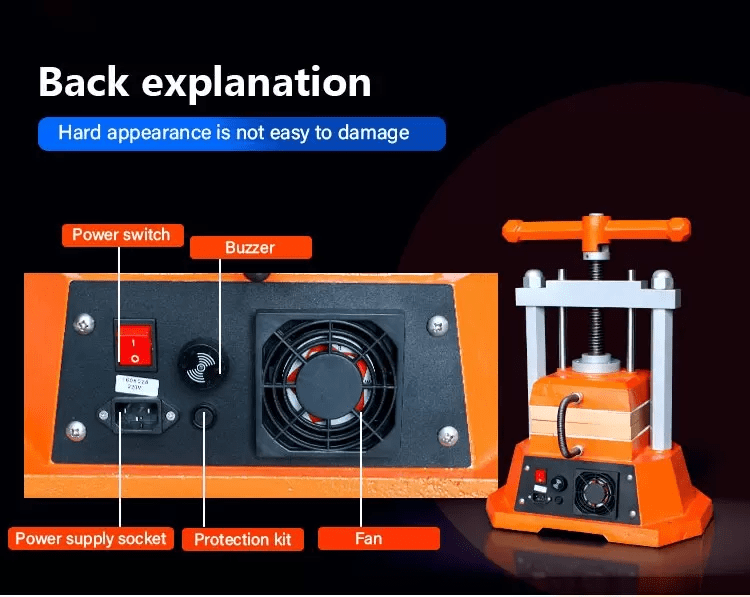

के तपाईलाई सुन परीक्षण मेसिन चाहिन्छ

Shipping Perks

Free standard shipping

within Kathmandu.

Return Policy

Full Return with reason if not satisfied.

Customer Service

Call us if you have any questions.

Genuine Product

We provide genuine products.

TOP SALE ON THIS WEEK

Features Products

OUR BUSINESS PARTNERS